Pre-merger integration

A. Initial situation:

Two separate global computer companies, needed support with their large scale merger integration program to accelerate the synergy benefit of the integration. One company offered hardware, software, services and financing. This company was profitable only in its imaging business line.

The other company was making losses in most business lines, such as hardware, software, services and personal computers. The two companies together had operations in more than 90 countries world-wide with more than 100,000 employees. The companies had manufacturing plant operations in more than 34 countries. More than 300 different IT systems in 34 countries were used. The companies experienced two very distinct different cultures. One company was “consensus” and voice mail oriented. The other company was more hierarchical and e-mail oriented.

Shareholders and management started a proxy battle. Investors and the business press expressed criticism of the business rationale for merger. There was a major risk of losing customers to competitors. In particular the top 1000 customers were at risk because of overlapping sales contracts, offerings and pricing strategies.

A clear business case and implementation plan for the merger had to be built and all stakeholders had to accept the feasibility of the plan and support the execution of the plan.

B. Methodology

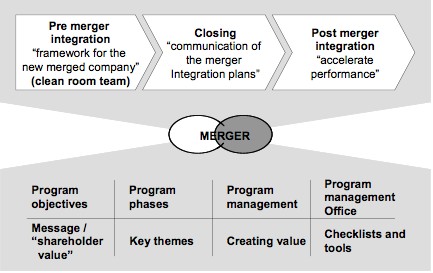

A comprehensive merger integration approach with three stages was excecuted:

1 Pre merger integration

2. Closing

3. Post merger Integration

C: Results

Based upon analysis of key financial metrics for a three year period the following results were identified.

An integrated product portfolio for the combined entity was achieved. No revenues were lost to competitors. One sales set of sales channels and customer contracts was set up. The combined entity realized value capture of $2.5B per year (annualized) within the first year of combined operations. Cultural integration of the whole workforce and no significant staff loss was achieved. A value capture of $3.5B annualized and a unified operating model, was realized the second year of combined operations.

The roll-out of new products and services was very successful, which contributed to a ten percent revenue growth in the first year. All product lines were profitable on a quarterly basis within the second year of operations.

The successful of the project yielded significant positive public attention.